straight life policy formula

This includes your premium payments insurer policies type of policy and loan balances. Judy and James have a 4-year.

Image Result For Lic Plan How To Plan Insurance Marketing Marketing

With the life expectancy of retirees continuing to lengthen having a guaranteed life.

. The Straight Life Option. Here are few things that you should know when you want to calculate cash value of life insurance. For double-declining depreciation though your formula is 2 x straight-line depreciation rate x Book value of the asset at the beginning of the year.

The expected present value of 1 one year in the future if the policyholder aged x is alive at that time is denoted in older books as nEx and. Updated Oct 15 2021. Straight life is the simplest benefit option offered by APERS.

Purchase price and other costs that are necessary to bring assets to be ready to use. Cost of the asset is the purchase price of the asset. Because of this the cash value will accumulate.

The term straight refers to the whole life insurance policys premium structure. To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset. Straight Line Depreciation Formula.

Decreasing term insurance is a type of renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Straight life insurance is. Adult child living with parents.

International Risk Management Institute Inc. Limited pay life insurance is a type of whole life insurance. The straight line depreciation formula for an asset is as follows.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Premiums are usually constant. Retired couple with a pension.

The primary unit for figuring out a life insurance rate is the rate per thousand cost per 1000 of insurance which can vary depending on which factors influence it age gender. February 27 2022. Also known as whole life insurance a.

This traditional life insurance is sometimes also known as. With a straight life policy a portion of your premium pays for the insurance and the rest. Single adult living alone.

Acquisition cost Salvage value Service life years. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Life Insurance retirement Whole Life Insurance.

Depreciation Expense Cost Salvage ValueUseful life. The straight life option pays a monthly annuity directly to the retiree for life. On the death of the.

A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single. First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. This phrase implies that premiums for the plan will remain constant and they will not rise or.

12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. Salvage value is the value. Straight-line Method Formula Depreciation Expense Cost Salvage ValueUseful life Cost.

The straight life annuity choice gives the retiree an income he cannot outlive. The depreciation amount is the same every year. Premium formula namely the pure n-year endowment.

D The actual amount of premium per year in a 10-pay life policy will be higher than straight life since the number of payments is reduced. The useful life of the assethow many years you think it will last. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Annuity Exclusion Ratio What It Is And How It Works

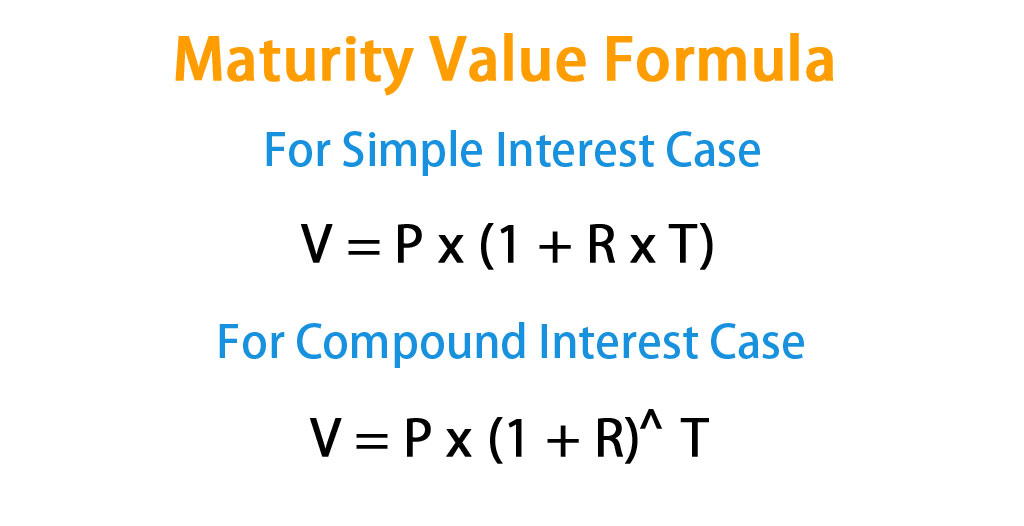

Maturity Value Formula Calculator Excel Template

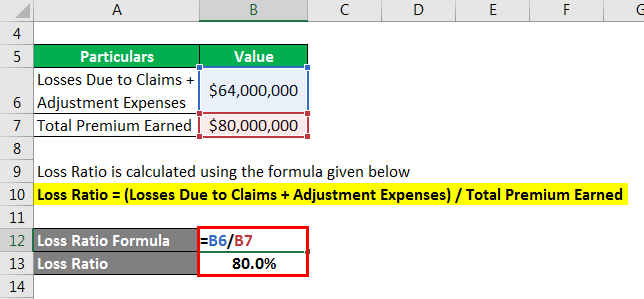

Loss Ratio Formula Calculator Example With Excel Template

Calculate Irr Formula With Excel With Screenshots

Depreciation Calculation Fixed Assets Presentations Only Course 100 Off Fixed Asset Bookkeeping Course Business Courses

Bottle Feeding Moms Breastmilk Or Formula Feel More Judged Every Time They Pull Out A Bottle In Public Than Yo Breastfeeding New Baby Products Bottle Feeding

Know The Sister Bra Sizes To Quickly Find A Bra That Fits Exercise I Work Out Fitness Motivation

Interact Quiz Review Using Quiz Software For Better Lead Generation Lead Generation Lead Generation Marketing Generation

Alkanes Study Chemistry Chemistry Lessons Chemistry Help

Loss Ratio Formula Calculator Example With Excel Template

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Depreciation Formula Calculate Depreciation Expense

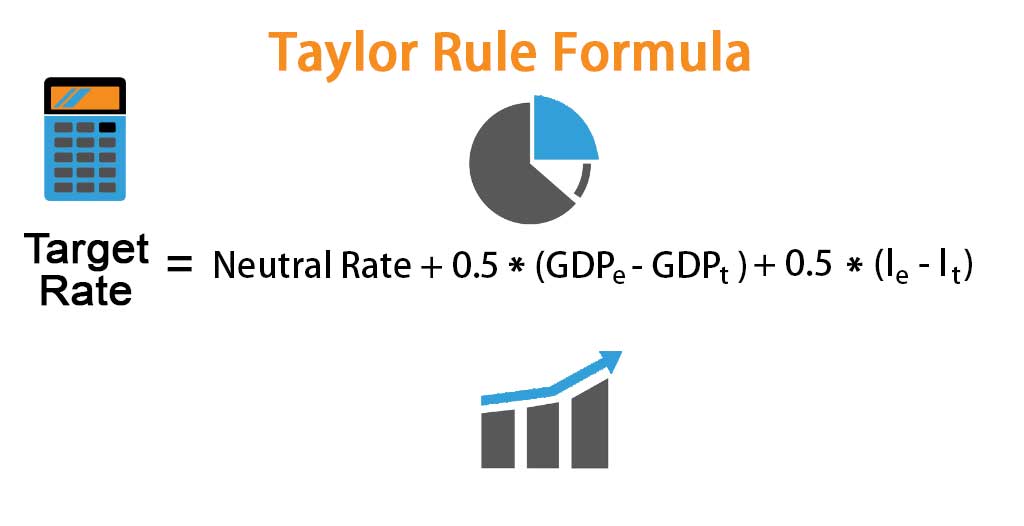

Taylor Rule Formula Calculator Example With Excel Template

Switching Your Baby To Formula Breastmilk To Formula Breastfeeding Baby Formula

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)